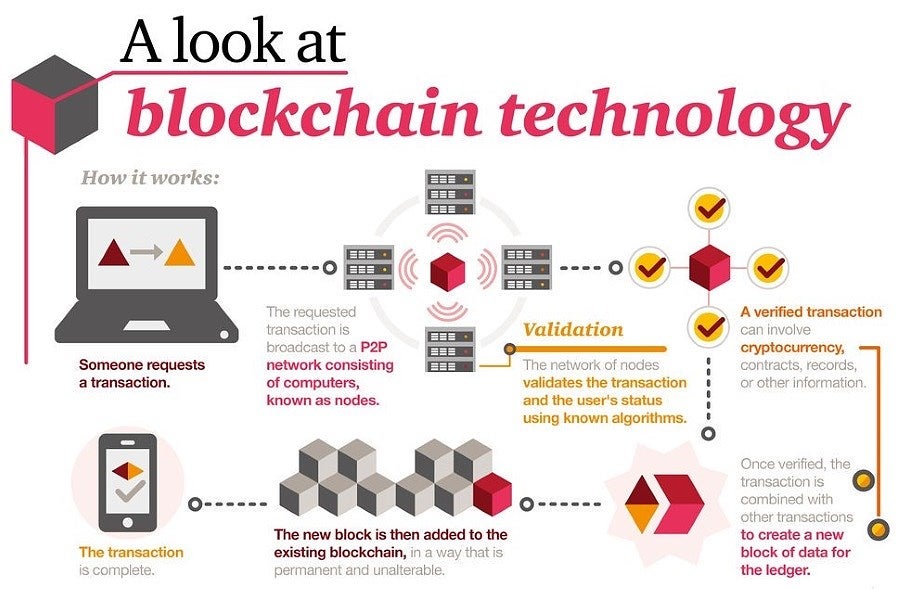

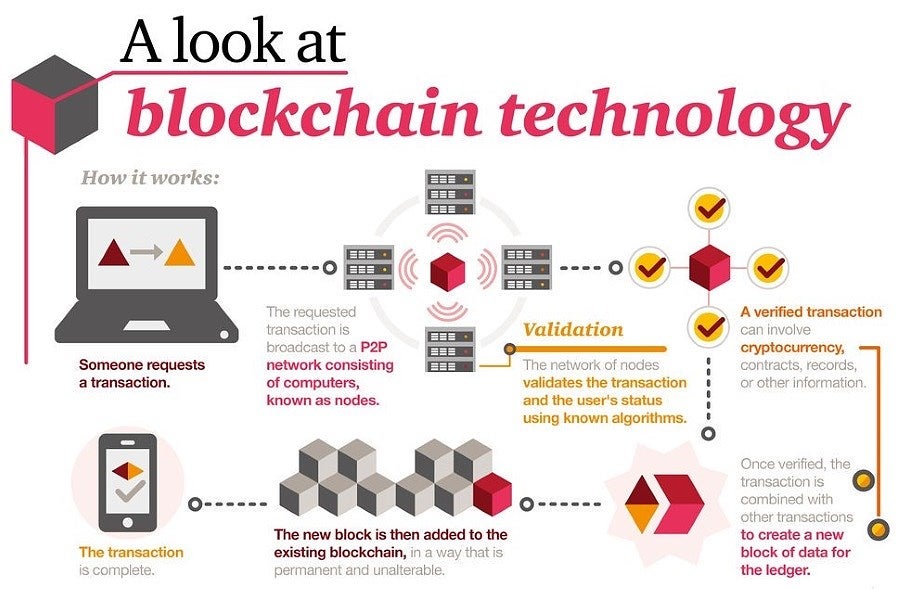

The emergence of cryptocurrencies has been accompanied by a wave of innovation that has put the nascent sector into the spotlight. Bitcoin’s model has been replicated and improved upon, and other cryptocurrencies have offered up their own takes on blockchain.

Alongside the industry’s expanding popularity, more companies are looking for ways to capitalize on blockchain, and existing solutions for development have shown their limitations. Ethereum, for example, is the most popular solution for blockchain-based apps, but recent events have prominently displayed its problems with scale and managing large network loads.

With these issues in mind, the Singapore-based Qtum Foundation created their own blockchain solution – QTUM – which deploys the more stable bitcoin chain while providing an app development environment akin to the capabilities Ethereum currently provides. The company is aiming to offer businesses an improved smart contract platform that extends functionality along with a more secure and transparent environment.

What Is Qtum?

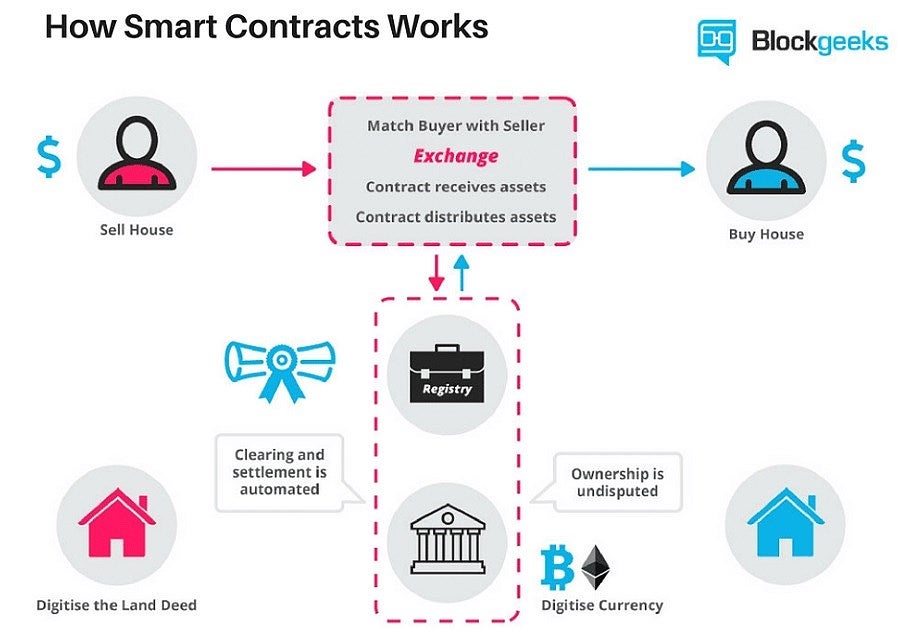

At its core, Qtum is a cryptocurrency designed to simplify the use of smart contracts for inter-business and institutional operations. More than simply a coin, however, the foundation created a blockchain solution that combines several aspects of two major cryptocurrencies – bitcoin and Ethereum – to facilitate interoperability between the two and take advantage of their major benefits.

Qtum is built on a bitcoin core fork, but the foundation has created its own hybrid blockchain with the help of several key tools. The coin uses bitcoin’s chain because of its simple and stable nature, allowing the foundation to build upon it more easily.

On top of the foundation, it uses a layer of abstraction that enables Qtum to combine several virtual machines that contribute different functionalities. Most important among these is the Ethereum Virtual Machine, which gives Qtum the ability to create its own smart contracts.

On a more granular level, however, each layer has a specific purpose. The bitcoin chain offers the foundation the ability to use the UTXO (Unspent Transaction Outputs) model, a simplified version of accounts that eschews the traditional banking account model in favor of a more peer-to-peer oriented one.

Instead of individual accounts that have sums debited when a transaction occurs, all transactions are written as bank checks. This way, users must specify just who the amount is being credited to, and the reason, simplifying the smart contract creation process. Users’ “balances” are then just the total of all the transactions they can complete.

The problem with UTXO is that Ethereum uses a more traditional account model, where users have balances that can be debited to complete a transaction, and their destination accounts have the same sum credited. This is one of the bigger problems in bitcoin-Ethereum interoperability, one which Qtum solves with an Account Abstraction Layer that translates bitcoin’s UTXO outputs into account-style data Ethereum can interpret.

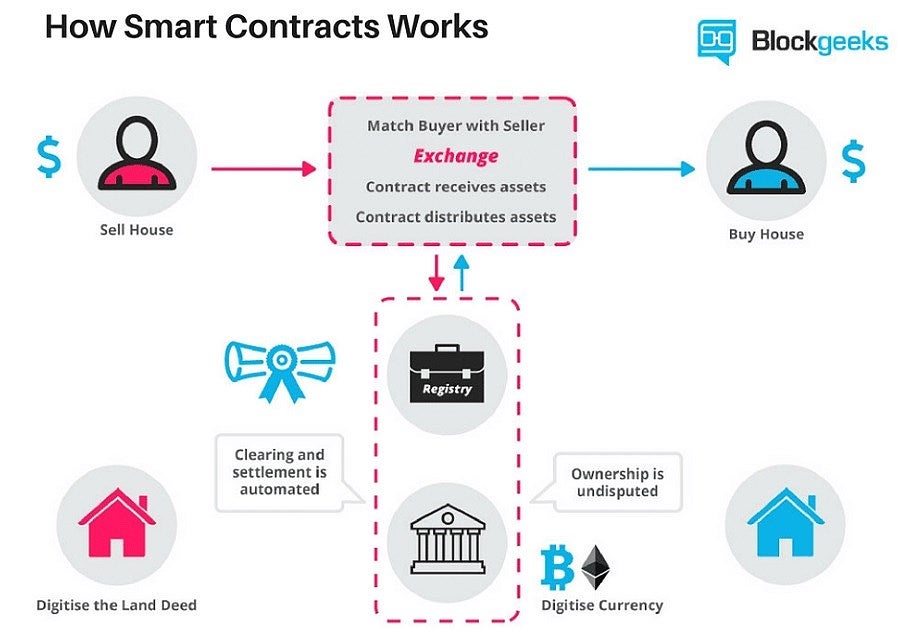

The Ethereum aspect is the other major component of Qtum, as it allows for the creation of smart contracts and decentralized applications (dApps). However, by combining it with bitcoin, Qtum draws on Ethereum’s attributes to focus its sights towards business and institutional adoption. All told, Qtum’s blockchain is based around stability, interoperability, and modular design, helping contribute to its overall value.

Proof of Stake – Qtum’s Value-Added Proposition for Businesses

One other major difference between Qtum and its building blocks that serve as the foundation for the platform is its use of Proof of Stake consensus over the more traditional Proof of Work.

PoW is the standard for bitcoin and is based around miners who validate transactions to create new blocks. The system was useful initially as adoption rates were low and processing each block was relatively easy.

The problem with PoW consensus is that as chains expand and the number of transactions increase, solving each block becomes significantly harder. This manifests in several ways. The first is that mining takes significantly longer, slowing down the overall speed of the network and transactions. The second is that because mining becomes exponentially more complex, better computers and systems are required, as well as large amounts of real-world power.

Mining operations use substantial amounts of electricity that costs fiat currency, putting pressure on cryptocurrency values. For business purposes, PoW becomes inefficient as thousands of transactions must be processed quickly and at relatively low costs. Having to wait hours for a transaction to be recorded and completed means businesses lose fiat money while they wait.

PoS consensus, on the other hand, randomizes the creator of every new block on the chain by introducing a deterministic algorithm that chooses based on wealth, or a user’s stake. This removes the block rewards for miners, and also the need for increasingly costly mining operations to which bitcoin and others have fallen prey. More importantly, all coins are mined when the blockchain is created, so there is no real reward outside of transaction fees, lowering overheads and expediting the speed of transactions.

For businesses, this model is preferable as it removes the need for competition and ensures that transaction fees remain low enough to make the system viable. Furthermore, because there is no need for mining, there is also no downward pressure on cryptocurrencies’ values from miners having to sell cryptocurrency to cover fiat expenses.

What Are the Uses for Qtum?

The Qtum Foundation has angled itself as a solution for businesses, offering a better way to embrace blockchain without the inherent risks and complications associated with bitcoin and Ethereum, but with all the benefits. Qtum offers businesses several advantages over its predecessors, making it impressively useful in a variety of situations.

The most obvious is their hybrid smart contracts, which thanks to UTXO, are more secure than Ethereum’s version. While the latter created smart contracts, there have been several well publicized incidents where the technology has underperformed, causing millions in losses. Instead, bitcoin’s secure transactions are now usable with Qtum smart contracts, offering an extra layer of protection.

One of the biggest appeals for Qtum users is the blockchain’s ability to create lightweight dApps in almost any computer language, as opposed to Ethereum’s somewhat restricted library. There are already several applications built on Qtum’s chain, including traditional services like healthcare records and marketing, as well as more unorthodox dApps focusing on food traceability, prediction markets, and artist copyright protections.

More importantly, Qtum is hoping to attract bigger institutional actors and become a bridge for business-to-business transactions thanks to their smart contract design. The company’s use of UTXO and Ethereum smart contracts means that it offers a truly trustless ecosystem for transactions, fully removing the need for middlemen all while reducing overheads for businesses.

Real-World Penetration

Qtum is past its initial stages and has already locked down agreements with several important companies that could quickly raise its profile while adding to its appeals as a central hub for blockchain development in the future.

The Qtum Foundation has already struck up a partnership agreement with Starbucks, though the terms haven’t been fully specified. Furthermore, to stay at the vanguard, the foundation has ironed out a relationship with China’s 360 Finance to create a blockchain research lab dedicated to improving the system’s underlying technology.

While still early in the year, many experts have high hopes for Qtum, and the cryptocurrency seems poised to fulfill its potential. While it must still prove itself to the private sector to gain momentum, the virtual currency could quickly become the dominant go-to for dApp development and offer businesses a safer, more effective, way to transact.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Crypto6 years ago

Crypto6 years ago

What is... ?7 years ago

What is... ?7 years ago

Crypto6 years ago

Crypto6 years ago

What is... ?7 years ago

What is... ?7 years ago

Bitcoin6 years ago

Bitcoin6 years ago

Crypto6 years ago

Crypto6 years ago

Bitcoin6 years ago

Bitcoin6 years ago

Bitcoin6 years ago

Bitcoin6 years ago