What is... ?

What is EOS ?

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi.

Published

7 years agoon

By

admin

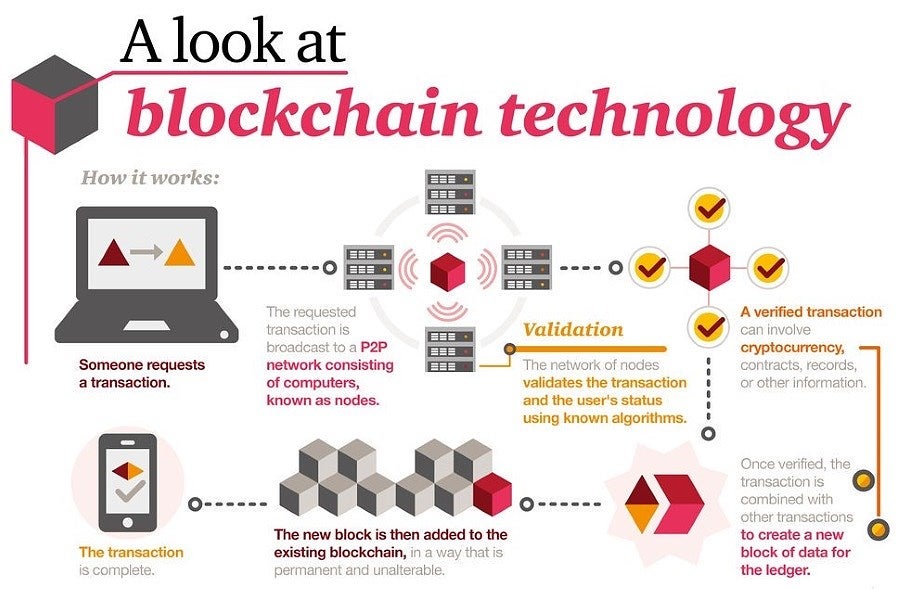

EOS Blockchain is aiming to become a decentralized operating system which can support industrial-scale decentralized applications.

That sounds pretty amazing but what has really captured the public’s imagination is the following two claims:

- They are planning to completely remove transaction fees.

- They are claiming to have the ability to conduct millions of transactions per second.

So, let’s see what is behind all this hype. In this guide, we will talk about everything EOS. However, before we do so let’s WHY we need something like EOS. Let’s answer the following question.

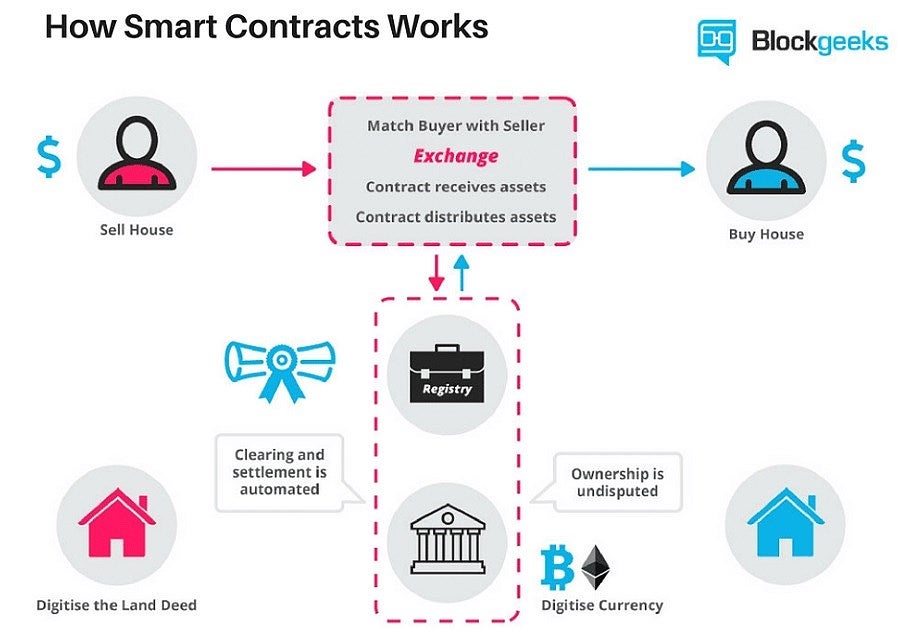

What do DAPPs require?

Or, to frame it more specifically, what does a DAPP require to be successful and a hit with the mainstream audience? What are its absolute minimum requirements?

- Support For Millions of Users

It should be scalable enough for millions of users to use it. This is especially true for DAPPs that are looking for mainstream acceptance.

- Free Usage

The platform should enable the devs to create dapps which are free to use for their users. No user should have to pay the platform to gain the benefits of a dapp.

- Easily Upgradable

The platform should allow the developers the freedom to upgrade the dapp as and when they want. Also, if some bug does affect the DAPP, the devs should be able to fix the DAPP without affecting the platform.

- Low Latency

A DAPP should run as smoothly as possible and with the lowest possible latency..

- Parallel Performance

A platform should allow their DAPPS to be processed parallelly in order to distribute the workload and save up time.

- Sequential Performance

However, not all the functions on a blockchain should be done that way. Think of transaction execution itself. Multiple transactions can’t be executed in parallel; it needs to be done one at a time to avoid errors like double spends.

So, what are the platforms available to us when it comes to DAPP creation?

- BitShares and Graphene have good throughput but are definitely not smart contract suitable.

- Ethereum is clearly the most obvious choice in the market. It has amazing smart contract abilities but the low transaction speed is a major issue. Plus, the gas price can be problematic as well.

EOS is thought of as a “best of both worlds” which combines the high throughput of Graphene and BitShares with the smart contract usability of Ethereum.

Now that we know why EOS was created, let’s look at the team behind the project

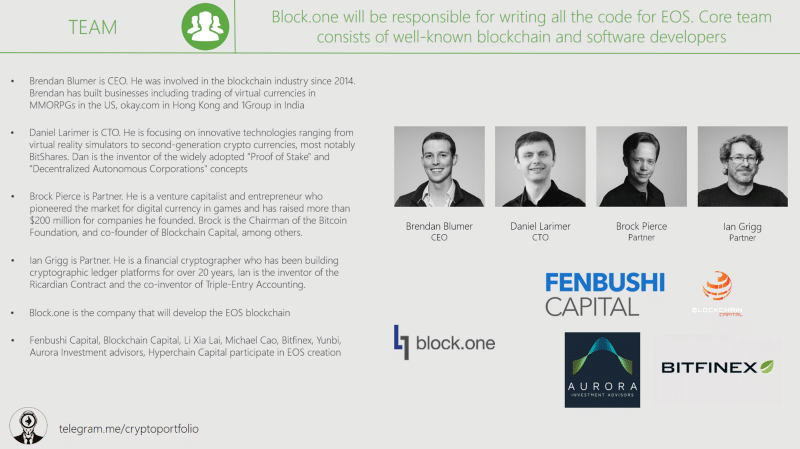

The Team Behind EOS Blockchain

The core team behind EOS is “Block.one”, which is based in the Cayman Islands. Brendon Blumer, the CEO, has been involved in blockchain since 2014. He has previously been involved in companies which dealt with currency exchanges in MMORPGs and in the real estate.

Dan Larimer, is the CTO. He is the creator of delegated proof-of-stake and decentralized autonomous organizations aka DAOs. He is the also the man behind BitShares and Steem.

What Does EOS Blockchain Bring To The Table?

Let’s check out some of the features of EOS.

- #1 Scalability

The biggest problem that the blockchain based space is facing is scalability issue

Visa manages 1667 transactions per second while Paypal manages 193 transactions per second. Compared to that, Bitcoin manages just 3-4 transactions per second while Ethereum fairs slightly better at 20 transactions per second.

The reason why blockchain-based applications can’t compute that many transactions per second are because each and every node of the network must come to a consensus for anything to go through.

EOS are claiming that because they use DPOS aka the distributed proof-of-stake consensus mechanism, they can easily compute millions of transactions per second. We will explore DPOS in a bit.

- #2 Flexibility

Ethereum’s entire system came to a standstill because of the DAO attack. Everything stopped and the community got split because of the hardfork.

Because EOS uses DPOS this is unlikely to happen again in their ecosystem. If a DAPP is faulty, the elected block producers can freeze it until the system is taken care of. This is simply an extension of the DPOS system, not every node has to take care of chain maintenance.

- #3 Usability

EOS allows well-defined levels of permission by incorporating features like web toolkit for interface development, self-describing interfaces, self-describing database schemas, and a declarative permission scheme.

- #4 Governance

In EOS the Governance is maintained by establishing jurisdiction and choice of law along with other mutually accepted rules This is usually done via the legally binding constitution. Every single transaction in EOS must include the hash of the constitution to the signature. This, in essence, binds the users to the constitution.

The constitution and protocol can be amended by the following process:

- The change is proposed by the block producer who obtains a 17/21 approval rate

- The 17/21 approval must be maintained for 30 straight days.

- All users are required to sign off their transaction using the hash of the new constitution.

- Block producers adopt changes to the source code to reflect the change in the constitution and propose it to the blockchain using the hash of a git commit.

- Block producers again need to maintain 17/21 approval for 30 consecutive days.

- After that, full nodes are given one whole week to adapt to the new changes.

- Any node that doesn’t follow the new protocol is automatically shut down.

So what happens if something like the DAO happens and the EOS system is forced to look for a quick change and solution to the protocol? In emergencies like that the block producers have the power to speed up the amending process.

- #5 Parallel Processing

In parallel processing, program instructions are divided among multiple processors. By doing this, the running time of that program decreases greatly. EOS provides parallel processing of smart contracts through horizontal scalability, asynchronous communication, and interoperability.

Let’s check out the meaning of each of those terms.

- Horizontal scalability: While in Vertical scalability scaling up is done by adding more processing power. Horizontal scalability on the other hand means scaling up by adding more systems and computers to the resource pool.

- Asynchronous communication: Communication that is not synchronized i.e. the parties involved need not be present in the same time to have a communication.

- Interoperability: Ability of a computer system to exchange and make use of information.

#6 Self-Sufficiency

Any blockchain based on the EOS software will have to generate a 5% natural inflation per year. This will be distributed to the platform’s block producers in connection with their confirmation of transactions on the platform and to the top three smart contracts or proposals that receive the most amount of votes from holders of such tokens.

The reason why this happens is to make sure that a blockchain is not reliant on any one single one foundation, organization, or individual for its growth, development or maintenance.

- #7 Decentralized Operating System

Probably the most critical feature to truly understand what EOS is all about is this feature.

Think of a MacOs/Windows with cryptoeconomic incentive.

Now, Ethereum is a decentralized supercomputer, EOS positions itself as an operating system. That in itself makes EOS, theoretically at least, a more focused product.

What is Delegated Proof Of Stake?

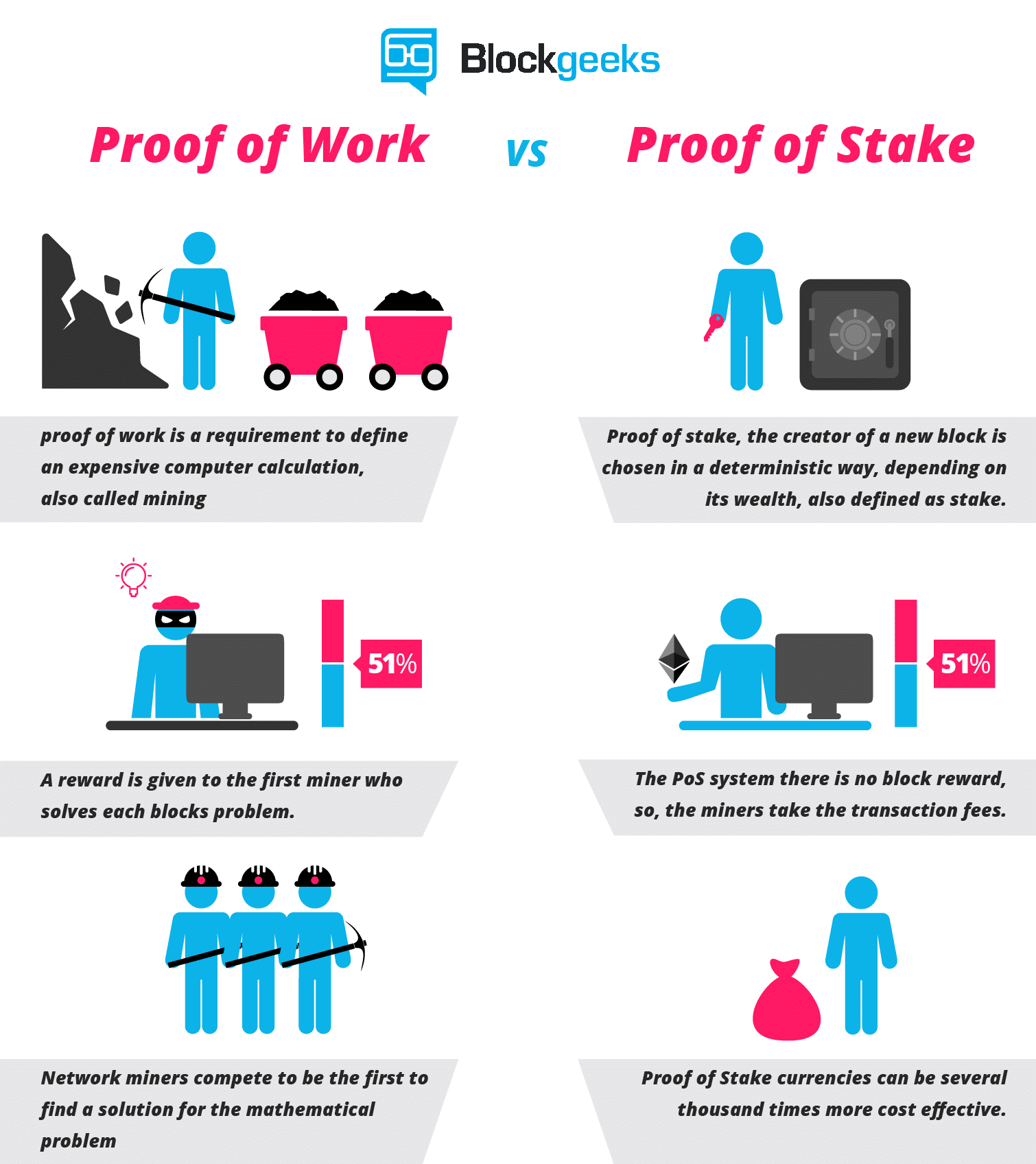

So, now we come to the consensus mechanism. As you are probably aware of, the most common consensus mechanism out there is proof-of-work, the one that is commonly used by Bitcoin.

Proof-of-work as a process has the following steps to it:

- The miners solve cryptographic puzzles to “mine” a block in order to add to the blockchain.

- This process requires immense amount of energy and computational usage. The puzzles have been designed in a way which makes it hard and taxing on the system.

- When a miner solves the puzzle, they present their block to the network for verification.

- Verifying whether the block belongs to the chain or not is an extremely simple process.

That, in essence, is what the proof-of-work system is. Solving the puzzle is difficult but checking whether the solution is actually correct or not is easy.

However, EOS is using the Delegated Proof of Stake (DPOS) for their consensus. So, how does it work? Before that let’s understand how proof-of-stake works

What is proof of stake?

Proof of stake will make the entire mining process virtual and replace miners with validators.

This is how the process will work:

- The validators will have to lock up some of their coins as stake.

- After that, they will start validating the blocks. Meaning, when they discover a block which they think can be added to the chain, they will validate it by placing a bet on it.

- If the block gets appended, then the validators will get a reward proportionate to their bets.

So, how is DPOS different from traditional POS?

Firstly, anyone who holds tokens on a blockchain integrated in the EOS software can select the block producers through a continuous approval voting system. Anyone can participate in the block producer election and they will be given an opportunity to produce blocks proportional to the total votes they receive relative to all other producers.

How does it work?

- Blocks are produced in the rounds of 21.

- At the start of every round 21 block producers are chosen. Top 20 are automatically chosen while the 21st one is chosen proportional to the number of their votes relative to the other producers.

- The producers are then shuffled around using a pseudorandom number derived from the block time. This is done to ensure that a balance connectivity to all other producers is maintained.

- To ensure that regular block production is maintained and that block time is kept to 3 seconds, producers are punished for not participating by being removed from consideration. A producer has to produce at least one block every 24 hours to be in consideration.

The DPOS system doesn’t experience a fork because instead of competing to find blocks, the producers will have to co-operate instead. In the event of a fork, the consensus switches automatically to the longest chain.

Confirming Transactions in DPOS?

A DPOS blockchain typically has 100% block producer participation. A transaction is usually confirmed within 1.5 seconds from the time of broadcast by a 99.9% certainty. In order to have absolute certainty over the validity of a transaction, a node need only to wait for 15/21 (i.e. a 2/3 majority) producers to arrive to a consensus.

So what happens in the event of a fork caused by negligence or malicious intent?

All the nodes will, by default, not switch to a fork which doesn’t include any blocks not finalized by 15/21 producers. This will stand true regardless of chain length. Each block must gain a 15/21 approval to be considered a part of the chain.

Because of the short block creation time, it is possible to warn nodes of whether they are in the major or minor chain within 9 seconds. The reason why that is so is simple. Remember, the average time elapsed between each block is 3 seconds.

- If a node misses 2 consecutive blocks there is a 95% chance that they in a minority fork.

- If a node misses 3 blocks, then there is a 99% chance of them being on a minority chain.

What is TAPOS?

Transaction As Proof Of Stake or TAPOS is a feature of the EOS software. Every transaction in the system is required to have the hash of the recent block header. This does the folllowing:

- Prevent transaction replay on different chains.

- Signaling the network that a user and their stake is on a particular fork.

This prevents validators from acting maliciously on other chains.

Eliminating Transaction Fees

EOS works on an ownership model whereby users own and are entitled to use resources proportional to their stake, rather than having to pay for every transaction. So, in essence, if you hold N tokens of EOS then you are entitled to N*k transactions. This, in essence, eliminates transaction fees.

The costs of running and hosting applications on Ethereum can be high for a developer who wants to test their application on the blockchain. The gas price involved in the early stages of development can be enough to turn off new developers.

The fundamental difference between the way Ethereum and EOS operate is that while Ethereum rents out their computational power to the developers, EOS gives ownership of their resources. So, in essence, if you own 1/1000th of the stake in EOS then you will have ownership of 1/1000th of the total computational power and resources in EOS.

As ico-reviews states in their article:

“EOS’s ownership model provides DAPP developers with predictable hosting costs, requiring them only to maintain a certain percentage or level of stake, and makes it possible to create freemium applications. Furthermore, since EOS token holders will be able to rent / delegate their their share of resources to other developers, the ownership model ties the value of EOS tokens to the supply and demand of bandwidth and storage.”

You may like

-

Bitcoin’s Mining Costs Will See It Bottom out at $6,000, Traders Argue

-

What is Bitcoin Gold (BTG) ?

-

Bitcoin Hits $24000 In Iran As Government Recognises Crypto Mining As An Industry

-

All You Need To Know About The Bitcoin ETF

-

Litecoin (LTC) Begins A New Cycle Against Bitcoin (BTC) But Still Risks A Fall Below $50

-

Cyber Criminals Are Finding Ways To Steal Your Cryptos

The emergence of cryptocurrencies has been accompanied by a wave of innovation that has put the nascent sector into the spotlight. Bitcoin’s model has been replicated and improved upon, and other cryptocurrencies have offered up their own takes on blockchain.

Alongside the industry’s expanding popularity, more companies are looking for ways to capitalize on blockchain, and existing solutions for development have shown their limitations. Ethereum, for example, is the most popular solution for blockchain-based apps, but recent events have prominently displayed its problems with scale and managing large network loads.

With these issues in mind, the Singapore-based Qtum Foundation created their own blockchain solution – QTUM – which deploys the more stable bitcoin chain while providing an app development environment akin to the capabilities Ethereum currently provides. The company is aiming to offer businesses an improved smart contract platform that extends functionality along with a more secure and transparent environment.

What Is Qtum?

At its core, Qtum is a cryptocurrency designed to simplify the use of smart contracts for inter-business and institutional operations. More than simply a coin, however, the foundation created a blockchain solution that combines several aspects of two major cryptocurrencies – bitcoin and Ethereum – to facilitate interoperability between the two and take advantage of their major benefits.

Qtum is built on a bitcoin core fork, but the foundation has created its own hybrid blockchain with the help of several key tools. The coin uses bitcoin’s chain because of its simple and stable nature, allowing the foundation to build upon it more easily.

On top of the foundation, it uses a layer of abstraction that enables Qtum to combine several virtual machines that contribute different functionalities. Most important among these is the Ethereum Virtual Machine, which gives Qtum the ability to create its own smart contracts.

On a more granular level, however, each layer has a specific purpose. The bitcoin chain offers the foundation the ability to use the UTXO (Unspent Transaction Outputs) model, a simplified version of accounts that eschews the traditional banking account model in favor of a more peer-to-peer oriented one.

Instead of individual accounts that have sums debited when a transaction occurs, all transactions are written as bank checks. This way, users must specify just who the amount is being credited to, and the reason, simplifying the smart contract creation process. Users’ “balances” are then just the total of all the transactions they can complete.

The problem with UTXO is that Ethereum uses a more traditional account model, where users have balances that can be debited to complete a transaction, and their destination accounts have the same sum credited. This is one of the bigger problems in bitcoin-Ethereum interoperability, one which Qtum solves with an Account Abstraction Layer that translates bitcoin’s UTXO outputs into account-style data Ethereum can interpret.

The Ethereum aspect is the other major component of Qtum, as it allows for the creation of smart contracts and decentralized applications (dApps). However, by combining it with bitcoin, Qtum draws on Ethereum’s attributes to focus its sights towards business and institutional adoption. All told, Qtum’s blockchain is based around stability, interoperability, and modular design, helping contribute to its overall value.

Proof of Stake – Qtum’s Value-Added Proposition for Businesses

One other major difference between Qtum and its building blocks that serve as the foundation for the platform is its use of Proof of Stake consensus over the more traditional Proof of Work.

PoW is the standard for bitcoin and is based around miners who validate transactions to create new blocks. The system was useful initially as adoption rates were low and processing each block was relatively easy.

The problem with PoW consensus is that as chains expand and the number of transactions increase, solving each block becomes significantly harder. This manifests in several ways. The first is that mining takes significantly longer, slowing down the overall speed of the network and transactions. The second is that because mining becomes exponentially more complex, better computers and systems are required, as well as large amounts of real-world power.

Mining operations use substantial amounts of electricity that costs fiat currency, putting pressure on cryptocurrency values. For business purposes, PoW becomes inefficient as thousands of transactions must be processed quickly and at relatively low costs. Having to wait hours for a transaction to be recorded and completed means businesses lose fiat money while they wait.

PoS consensus, on the other hand, randomizes the creator of every new block on the chain by introducing a deterministic algorithm that chooses based on wealth, or a user’s stake. This removes the block rewards for miners, and also the need for increasingly costly mining operations to which bitcoin and others have fallen prey. More importantly, all coins are mined when the blockchain is created, so there is no real reward outside of transaction fees, lowering overheads and expediting the speed of transactions.

For businesses, this model is preferable as it removes the need for competition and ensures that transaction fees remain low enough to make the system viable. Furthermore, because there is no need for mining, there is also no downward pressure on cryptocurrencies’ values from miners having to sell cryptocurrency to cover fiat expenses.

What Are the Uses for Qtum?

The Qtum Foundation has angled itself as a solution for businesses, offering a better way to embrace blockchain without the inherent risks and complications associated with bitcoin and Ethereum, but with all the benefits. Qtum offers businesses several advantages over its predecessors, making it impressively useful in a variety of situations.

The most obvious is their hybrid smart contracts, which thanks to UTXO, are more secure than Ethereum’s version. While the latter created smart contracts, there have been several well publicized incidents where the technology has underperformed, causing millions in losses. Instead, bitcoin’s secure transactions are now usable with Qtum smart contracts, offering an extra layer of protection.

One of the biggest appeals for Qtum users is the blockchain’s ability to create lightweight dApps in almost any computer language, as opposed to Ethereum’s somewhat restricted library. There are already several applications built on Qtum’s chain, including traditional services like healthcare records and marketing, as well as more unorthodox dApps focusing on food traceability, prediction markets, and artist copyright protections.

More importantly, Qtum is hoping to attract bigger institutional actors and become a bridge for business-to-business transactions thanks to their smart contract design. The company’s use of UTXO and Ethereum smart contracts means that it offers a truly trustless ecosystem for transactions, fully removing the need for middlemen all while reducing overheads for businesses.

Real-World Penetration

Qtum is past its initial stages and has already locked down agreements with several important companies that could quickly raise its profile while adding to its appeals as a central hub for blockchain development in the future.

The Qtum Foundation has already struck up a partnership agreement with Starbucks, though the terms haven’t been fully specified. Furthermore, to stay at the vanguard, the foundation has ironed out a relationship with China’s 360 Finance to create a blockchain research lab dedicated to improving the system’s underlying technology.

While still early in the year, many experts have high hopes for Qtum, and the cryptocurrency seems poised to fulfill its potential. While it must still prove itself to the private sector to gain momentum, the virtual currency could quickly become the dominant go-to for dApp development and offer businesses a safer, more effective, way to transact.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Cryptocurrency forks of various types now take place on a regular basis. Even bitcoin has experienced several different iterations and branches in this way. One of the largest and most discussed bitcoin forks took place late in 2017.

Bitcoin gold was a hard fork of the original open source cryptocurrency which took place on October 24, 2017. While hard forks take place for a number of reasons – including for the purposes of scaling as a cryptocurrency customer base grows, or because of developer conflict and differences of goals – bitcoin gold’s stated purpose has been to “make bitcoin decentralized again.”

On the surface, the idea of “making bitcoin decentralized again” may seem counterintuitive. Bitcoin, like all other cryptocurrencies, is designed to be decentralized already; it is not linked with any central bank, particularly country, or government body.

One of the major issues with bitcoin which prompted the development of bitcoin gold, however, was not related to the question of central issuance at all. Rather, it had to do with the mining process. Bitcoin gold developers believed that by adopting a new algorithm for the mining process (in this case, a so-called proof-of-work algorithm called Equihash), the new branch of the world’s most popular cryptocurrency by market cap would not disproportionally favor major mining operations.

Democratizing the Mining Process

Bitcoin mining is a lucrative but resource-intensive process. The most profitable mining ventures are often those which pool together a large number of mining rigs, each of which requires expensive, special equipment.

Individuals attempting to mine for bitcoin on their own either have to invest a huge amount of money and time into creating their own rigs, or they get passed by in the process, as their computers are unable to compete with the professional rig systems.

One of the primary goals of bitcoin gold has been to change the algorithm by which the cryptocurrency itself is mined, meaning that the mining process cannot be run faster on specialized equipment than it can on standard computer systems.

Bitcoin gold was not the first major hard fork of bitcoin. Bitcoin cash forked off from the primary cryptocurrency in August of 2017.

In 2018, bitcoin is anticipating several additional hard forks, prompting some to speculate that there may be diminishing returns in terms of investor interest as more offshoots of bitcoin reach the market.

Distribution, Protection, Transparency

Besides the goal of “re-decentralizing” bitcoin, bitcoin gold’s developers were also focused on issues relating to distribution, protection, and transparency. “Hard forking bitcoin’s blockchain fairly and efficiently distributes a new digital asset immediately to people all over the world who have interest in cryptocoins,” the bitcoin gold website states.

In the world of virtual currencies, threats from hackers and other malicious entities are constantly a concern. For that reason, bitcoin gold took additional safety and protective measures from the time of its launch, in an effort to help secure its customers’ accounts and coins. These include replay protection and unique wallet addresses.

The fact that bitcoin gold is “a free open-source software project that is built by volunteer developers and supported by a rapidly growing community of bitcoin enthusiasts that stretches around the globe” is also a draw for potential customers.

Bitcoin Gold On Exchanges

For all cryptocurrencies, one of the major factors which helps to determine both short-term and long-term success is its availability on cryptocurrency exchanges. Users must be able to access the cryptocurrency on exchanges in order to make transactions.

According to the bitcoin gold website, as of March 2018, the cryptocurrency was trading live on Bithumb, Bitfinex, Binance, Bittrex, HitBTC, Uphold, YoBit, Gate.io, Changelly, Shapeshift, BitBay, Abucoins, Change Now, Evercoin, Tdax, Bitsane, Bitstarex, QuadrigaCX, Cex.io, Okex, Anybits, BestRate, Bitmarket, Indacoin, CoinSwitch, and Unocoin.

There are additional exchanges slated to offer bitcoin gold in the near future as well. The cryptocurrency is also available through a number of wallet services, including Trezor Wallet, Ledger Wallet, Exodus, Coinomi, Bitpie, Guarda, Freewallet, BTGWallet, and Kasse. According to the website, the cryptocurrency has been listed on 46 markets and 26 exchanges as of January, 2018.

Launch and Controversy

The developers of bitcoin gold used what is called “post-mine” after the launch. This was the retroactive mining of 100,000 coins after the fork already took place. The way that this happened was through the rapid mining of about 8,000 blocks, the results of which were set aside as an “endowment” of sorts, to be used to grow and maintain the broader bitcoin gold network.

About 5% of those 100,000 coins were set aside for each of the six primary team members as a bonus. At the time of the launch, all bitcoin owners received bitcoin gold coins at the rate of one bitcoin gold token per one bitcoin token.

Coinbase, one of the largest cryptocurrency exchanges in the world, was notably skeptical of bitcoin gold at launch time. Coinbase representatives stated that the exchange “cannot support bitcoin gold because its developers have not made the code available to the public for review. This is a major security risk.”

As of March 4, 2018, bitcoin gold has 253 reachable nodes. The highest concentration of nodes is in Germany (46 nodes), with the next-highest levels being the United States (38), France (37), and Russia (18).

In February 2018, bitcoin gold launched the bitcoin gold insight explorer, calling it a “fully functional bitcoin gold insight instance and web application service presenting the Insight UI and Insight API.”

Like most cryptocurrencies, bitcoin gold has had its share of detractors and controversies. Just days after the launch, miners accused one of the developers of bitcoin gold of having added in a 0.5% mining fee that was hidden from the mining community.

The Future of Bitcoin Gold

According to the bitcoin gold website, the cryptocurrency maintains ambitious plans for expansion into the future. In the first quarter of 2018, for instance, the website says its goals including “open source libraries integration” with BitcoinJS, BitcoinJ, and CoPay, as well as “academic and university collaboration” and “design and rebranding,” including a refreshed website.

In the second quarter of 2018, the digital currency aims to integrate a lightning network and decentralized mining through P2Pool. There is also a plan to integrate a debit card program and other payment systems integrations.

By the end of 2018, the cryptocurrency aims to develop “sidechains and cross-chain atomic swaps” as well as a number of meet-ups and developer conferences, university outreach, and more. Looking ahead to 2019, the cryptocurrency has its sights on private transactions and scholarship or research support.

Over the longer term, bitcoin gold will conduct research on smart contracts and blockchain democracy, as well as develop a decentralized fiat-crypto brokerage network.

Bitcoin gold developers are conscious of the connections between this cryptocurrency, its parent bitcoin, and the broader digital currency world. As such, they indicate that “the core improvements we’re working on are all of great interest in the broader bitcoin and crypto worlds, not merely for bitcoin gold.” They said some of these unilaterally applicable improvements may include scalable ways to address hard forks, “smart voting mechanisms,” and decentralized decision-making for the development of the digital currency.

Investing in cryptocurrencies and Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns bitcoin and ripple.

NANO officially rebranded from RaiBlocks at the end of January 2018. The team behind the cryptocurrency, RaiBlocks announced that the coin is rebranded to NANO.

NANO follows Bitcoins‘ original plan which is to replace traditional currencies, making it digital money for day to day use.

In the quest of taking over Bitcoin, NANO addresses vital problems posed by Bitcoin network which are:

- Scalability problems which give users concerns about the increase in transaction fees on the Bitcoin network.

- Computational issues which have to do with the latency of transaction times which stands at an average of 164 minutes.

- Energy consumption is soaring high with Bitcoin mining consuming more electricity than 159 countries.

Addressing these challenges, NANO provides a solution which gives the cryptocurrency and edge over Bitcoin with its block-lattice structure which delivers zero-fee transactions and consumes way less energy than that of Bitcoin.

How The System Works

Unlike other blockchain technologies many cryptocurrencies adapt, each account has its blockchain. Each account-chain, as its also referred to is updated by the account owner and in turn, asynchronously updates the rest of the block-lattice resulting in fast transaction times. Since each user updates its block sending and receiving funds requires two transactions; a sending transaction which deducts the amount sent by a sender from his balance, likewise the receive transaction which adds amount gotten from sender to its account balance. These two transactions don’t have to be at the same time; the receiver can accept the transaction anytime.

Explaining Block-Lattice Architecture

NANO uses a Directed Acyclic Graph (DAG) block-lattice architecture, where every individual is assigned his blockchain. Unlike other blockchain architecture which tracks transaction amounts, the block-lattice records account balances. This method shrinks down data stored through the use of database pruning. Every blockchain reflects information related to individual’s account and is only updated by the owner; then each blockchain is updated asynchronously to the rest of the block-lattice.

NANO uses a Directed Acyclic Graph (DAG) block-lattice architecture, where every individual is assigned his blockchain. Unlike other blockchain architecture which tracks transaction amounts, the block-lattice records account balances. This method shrinks down data stored through the use of database pruning. Every blockchain reflects information related to individual’s account and is only updated by the owner; then each blockchain is updated asynchronously to the rest of the block-lattice.

As every user controls their blockchain, protocols such as proof-of-work (PoW) or proof-of-stake (PoS) in deciding on the state of the ledger is not needed.

To Create An Account

Users need to initiate an open transaction. This transaction is the first of every account-chain and is created upon receiving the first transaction block.

Account Balances

All balances are recorded within users account-chain. Instead of recording the amount of transaction, verification process requires checking the difference between the previous send block balance and the current one. The new block increases or decreases with the final balance on the new receive block. This is to improve processing speed when downloading high numbers of transaction blocks.

Sending From An Account

The sending address must already have an opened block, and therefore a balance. Once a transaction is initiated, it cannot be reversed once confirmed. Once the transaction is broadcasted to the network, funds are immediately deducted from senders balance and are pending until the receiving party signs the block to accept the funds. Pending acceptance, the funds should be considered spent on senders account though it hasn’t been received as the sender cannot revoke the transaction.

Receiving Transactions

To complete the transaction process, the receiver creates a block on its account to accept a sent fund. Once the block is created and broadcasted, the account balance is updated with the new balance.

What’s Interesting About The Block-Lattice Infrastructure

Because of its lightweight protocol and cost of running a node next to nothing, transactions are processed without fees. Each transaction on the network is fitted in a UDP packet and handled independently, eliminating block size issues.

Also, wallets are pre-cached for the next transaction once a transaction is sent, making transactions instant as both sender and receiver have proof of work ready to go.

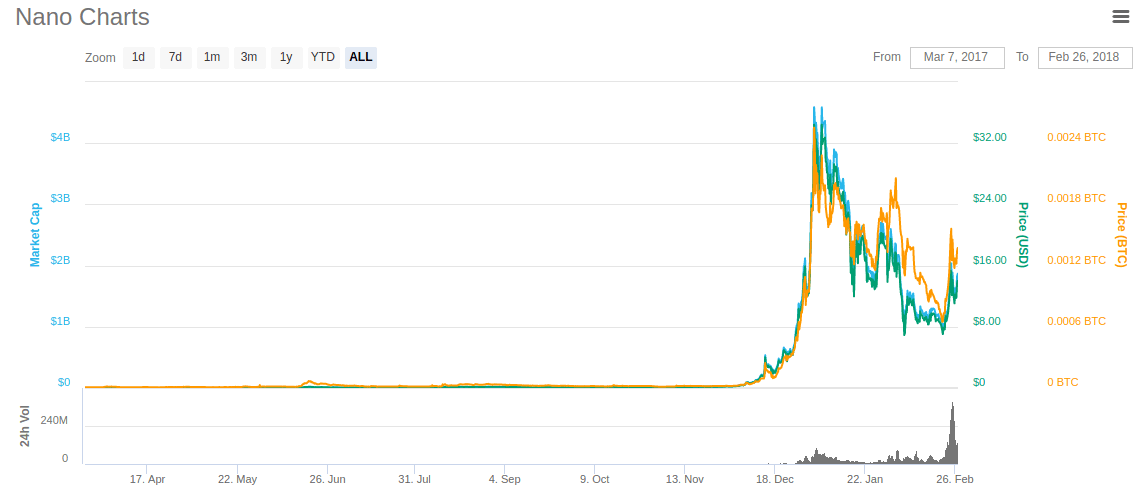

NANO’s Price Over Time

The NANO (represented as XRB symbol on most exchanges) has been stable, almost static at its lows since inception. Not until recently, the latter part of 2017, did we see a spike in price as it made a high of $4.02 on the 12th of December, 2017. It has since continued to make huge gains with all-time highs at $33.14. Currently at $13.27 after a pullback.

It is clear that after the rebrand announcement, the NANO has come into limelight and has had a good number of people adopting the cryptocurrency. The NANO currently has a market cap of $1.76 Billion.

Where To Buy NANO

NANO has since been added to significant exchanges after its rebrand. The NANO can be exchanged for major cryptocurrencies like the Bitcoin, Ether, Binance Token, Tether USDT, Doge, and fiat currencies.

NANO can be exchanged on Binance, Kucoin, RightBTC, Bit-Z, Mercatox, OKEx, and CoinFalconexchanges. You can also purchase NANO using cash on the BitFlip exchange.

NANO Compatible Wallets

There are a few options for storing and transacting with the NANO cryptocurrency. You can hold your NANO in the following wallets:

- There is an official web wallet, hosted on raiwallet.com.

- RaiWalletBot is a telegram bot which manages user private keys allows users access, send and receive NANO coins on the telegram app.

- You can also use the Ledger Hardware wallet to hold your NANO cryptocurrencies.

Plans For The Future

The NANO is aimed at revolutionizing the blockchain architecture itself and will undoubtedly have a bright future.

The community has helped get the cryptocurrency on quite a few exchanges, and we should expect even much more shortly.

Mobile wallets are currently under testing and would be released for iPhone and Android mobile devices early 2018.

Conclusion

What NANO aims to achieve is simple. To replace the conventional shared memory data structure with the message passing model in which users have their blockchains that only syncs with the main network. The NANO is the only cryptocurrency which employs the block-lattice (multi-dimensional blockchain) freeing users from paying fees to miners, waiting for network ledger update and also avoiding long transaction confirmation times.

With the solution NANO presents, cryptocurrencies, most especially the NANO will be that digital currency that replaces fiat currencies for everyday use.

Bitcoin’s Mining Costs Will See It Bottom out at $6,000, Traders Argue

What are Forks and Airdrop in Cryptocurrency?

What Next For Ethereum (ETH)?

Trending

-

Crypto6 years ago

Crypto6 years agoWhat is Dash ?

-

What is... ?7 years ago

What is... ?7 years agoWhat is Ethereum ?

-

Crypto6 years ago

Crypto6 years agoMonero (XMR) Might Soon Be The Next Big Thing As Spotlight Turns From Blockchain To Privacy

-

What is... ?7 years ago

What is... ?7 years agoWhat is Ripple ?

-

Bitcoin6 years ago

Bitcoin6 years agoAll You Need To Know About The Bitcoin ETF

-

Crypto6 years ago

Crypto6 years agoWhat Is Tether (USDT) ?

-

Bitcoin6 years ago

Bitcoin6 years agoBitcoin (BTC) Dominance Faces Resistance While Altcoins All Set To Take Off

-

Bitcoin6 years ago

Bitcoin6 years agoArtificial Intelligence Is Developing Close Contact With Blockchain